bankaroo

THE VIRTUAL BANK FOR KIDS

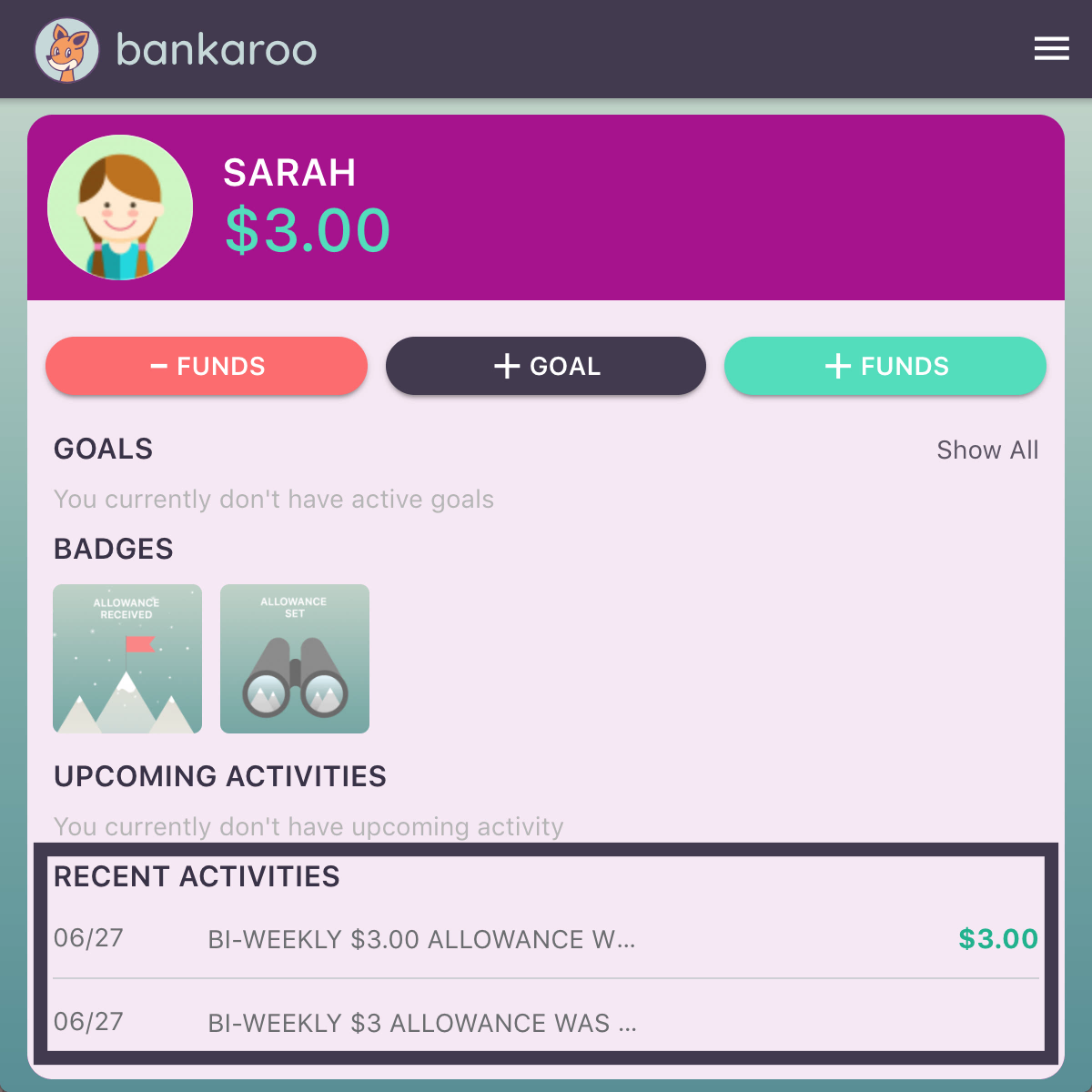

Bankaroo is a virtual bank for kids, where you can teach them about the value of money in a safe environment.

Kids will learn how to budget, save up for goals and spend responsibly using our cool easy-to-use app and website.

“A really useful way to keep track of kids pocket money and spending.”

– Amanda M.

“Excellent for piggy-banking. We and our kids love this app. It works well and gives the kids a sense of how to set goals and save. Developer is responsive and active, which is a huge plus.“

– The Huang Family

“Best kids bank out there & Super responsive help if you have a problem AWESOME customer service. Very responsive developer. BEST kids bank app by far (and I researched/tested this extensively, even paying for one lousy one).“

– Kathleen M.

MOBILE APPS

Just log-in to Bankaroo from any browser while online.

Download Bankaroo native apps for iOS, Android and Kindle phones, and tablets.

Get offline functionality, faster image upload and notifications.

Bankaroo PLUS (formerly, bankaroo gold) is an enhanced edition where kids can manage separate accounts for checking, savings, and charity. As well as, transfer funds between family members.

Bankaroo Student is a FREE app for students using the Bankaroo in their schools.

FREQUENTLY ASKED QUESTIONS

General FAQ

What is Bankaroo?

Bankaroo is an educational virtual bank for kids that helps kids learn about money, budgeting, setting goals, saving up, and being accountable for their decisions. It offers a family-friendly interface and is accessible via the web and mobile apps.

Is Bankaroo free?

Bankaroo can be used for free as a web and mobile-web service. Paid versions are available but payment is not required in order to use the service.

What services does Bankaroo offer?

There are 4 editions of Bankaroo.

- Bankaroo online – a free online (web and mobile-web) service

- Bankaroo – the Bankaroo mobile app, offering account syncing across devices and some offline capabilities

- Bankaroo Plus – an enhanced service where kids can manage separate accounts for checking, savings, and charity, has the ability to transfer funds between family members

- Bankaroo for Schools – a special edition for teachers who like to use Bankaroo in their class, includes an online portal for teachers and a mobile app for students

How old should my kids be to use Bankaroo?

Bankaroo is designed for kids with basic reading skills. Most of our members are 5-14 years old.

What can my kid do with his or her account?

Kids are encouraged to set goals, log usage of funds toward one-time activities or goals, and track past activities. Kids can check their account balance and see upcoming and past transactions. Bankaroo was designed to enable and improve communication between kids and parents and provide opportunities for kids to take initiative and manage their funds, with the help of parents.

Will Bankaroo work on my mobile device?

It definitely should. You can use the free mobile-web version and experience it via your mobile browser, or download the native app for enhanced experience, syncing between devices, and offline capabilities. Check out Google Play, Amazon and the App Store for additional details.

Can I get account snapshots and other updates via email?

Sure you can! Subscribe to receive email notifications in the ‘Account Settings’ menu and you will receive beautiful, informative emails.

Does Bankaroo work offline?

Yes, but… The web and mobile-web version do not work when you are offline. The mobile app does work and allows you to view and perform some tasks, such as setting new goals.

Some actions are available only when you are online, like using funds. This is because the Bankaroo system needs to verify the account has enough funds to be able to allocate them toward a goal, payment or transfer, and that is possible only then the user is online.

How do I manage my notification preferences?

Simply access your account settings and update your preferences.

How can I introduce Bankaroo to a friend?

REVIEW

Can I invite others to manage my kid's account?

Yes, you can send invite other adults to your account and grant them different level of access. Click on the menu and select “invite friends and family”.

How can I help Bankaroo?

We would love to get your help.

- Email us support@bankaroo.com with any question, idea or comment. We love to improve based on feedback

- Give Bankaroo a positive review in the App stores

- Share Bankaroo with your family, friends, schools and community

- Like us on Facebook

How can I get support?

We would love to hear from you and hear how can we help you and improve Bankaroo. Please use the contact form con contact us, or email support@bankaroo.com.

Security

Why do I need to register with my email?

Parents are required to register using their email to allow account and information verification per the Children’s Online Privacy Protection Act (COPPA). You can opt in to weekly account updates and other Bankaroo news. Bankaroo DOES NOT require kids’ email address, real names or mobile numbers.

Is Bankaroo secure?

Bankaroo is a virtual bank and does not hold or manage real funds. Nevertheless, we take security seriously – Bankaroo runs on a secured server and all the data in encrypted. All communications are on HTTPS protocol and parents have full control who has access to their account.

Why do kids have a password?

We believe kids should learn to be independent and should have the full login experience. Also, it allows kids to share the same device without messing with a sibling’s or other student’s account.

Account Settings (Parents and Kids)

Can I change my email address?

Parents can change their email address and communication preferences in the settings panel.

Parents can change their email address and communication preferences in the settings panel.

How do kids login to Bankaroo?

Kids login to Bankaroo using the username (or nickname) and password their parent chose when creating their account. Bankaroo does not allow email addresses for kids.

How do I create a kid account?

After creating a parental account, click on the “Add a Kid Account” button on your home screen.

After creating a parental account, click on the “Add a Kid Account” button on your home screen.

How can I apply interest toward savings and balance?

You can apply interest towards savings in the kid’s account settings panel.

You can apply interest towards savings in the kid’s account settings panel.

How do I edit or delete a kid account?

Click on the menu button and select “Edit Kid Accounts”. This lets you select a pencil to edit an account or a trash can to delete the account.

Click on the menu button and select “Edit Kid Accounts”. This lets you select a pencil to edit an account or a trash can to delete the account.

How do I reset my kid's account password?

You can edit the kid’s account info, including their password, in the “Edit Kids” account section.

You can edit the kid’s account info, including their password, in the “Edit Kids” account section.

Can I use a photo for my kid's avatar?

Sure thing! You can select from list of common avatars or upload your own using your computer or the Bankaroo mobile app.

What is 'match savings'?

Parents can choose to match a kid’s savings up to a set amount to encourage him or her to save. For example, a parent can give their kid $0.50 for every $1 the kid saves. Access this option in the kid’s account settings.

Parents can choose to match a kid’s savings up to a set amount to encourage him or her to save. For example, a parent can give their kid $0.50 for every $1 the kid saves. Access this option in the kid’s account settings.

Can a kid create a Bankaroo account?

Yes and no… The parent (or teacher) creates the main account, then adds kid accounts from there. A kid cannot create an account without a parental main account. The kid is welcome to help with choosing the username (usually a nickname), his or her password, avatar, colors, and other cool stuff.

How can I set up checking, saving, and charity accounts?

When you sign up for the Bankaroo Plus edition, your main account turns into your Checking account and you have access to additional Savings and Charity accounts under your username.

Adding and Using Funds

How can I set an allowance?

You can set an allowance by opening the kid’s settings panel and defining the amount and frequency of the allowance. You can edit this information later and it will affect future transactions.

How do I add funds?

By default, only a parent can add funds to the kids accounts, and you can edit it in the kid’s account settings. Look for the “+Funds” green button and provide the needed info. You can also set an allowance in the kid’s account settings panel. This would add funds to the account automatically.

By default, only a parent can add funds to the kids accounts, and you can edit it in the kid’s account settings. Look for the “+Funds” green button and provide the needed info. You can also set an allowance in the kid’s account settings panel. This would add funds to the account automatically.

Can my kid add funds to his or her account?

By default, only a parent can add funds to a kid’s account. You can change this setting in the kid’s account settings panel.

How do I set up a recurring payment?

To create a recurring payment, click the “-Funds” button and select “Recurring”. You can set the amount and frequency in the options pane. Click “Done” and you will see the activity listed in the past and upcoming lists.

To create a recurring payment, click the “-Funds” button and select “Recurring”. You can set the amount and frequency in the options pane. Click “Done” and you will see the activity listed in the past and upcoming lists.

How do I edit a future activity?

To edit a future activity, simply go to the upcoming activity panel and click on the activity. You can then edit or delete it.

To edit a future activity, simply go to the upcoming activity panel and click on the activity. You can then edit or delete it.

Can kids transfer funds between accounts?

Yes, kids with a Bankaroo Plus account and students using Bankaroo for Schools can transfer funds between family members or other students.

Can I edit or delete a past entry?

While you can edit past descriptions, you cannot change the amount of a past addition or deduction of funds.

While you can edit past descriptions, you cannot change the amount of a past addition or deduction of funds.

How can I earn badges?

Badges are earned by engaging with the Bankaroo app and performing tasks such as creating and completing goals.

How can I see past activities?

There is a list of past activities underneath the goals, badges, and upcoming activities listed on your kid’s account.

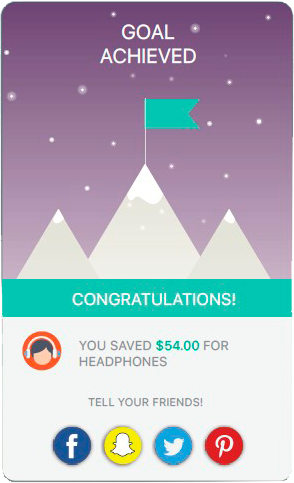

Goals

How do I set a goal?

Simply click the “+Goal” button and enter the needed info. Do not forget to add a photo and a clear description. In case you need to edit, just click the goal in the upcoming activities and edit from there.

Simply click the “+Goal” button and enter the needed info. Do not forget to add a photo and a clear description. In case you need to edit, just click the goal in the upcoming activities and edit from there.

How do I allocate funds towards a goal?

Use the “-Funds” button and select “For Goal” from the options. You will see a list of active goals to select. Note that a goal must be made first in order to appear in this menu.

Use the “-Funds” button and select “For Goal” from the options. You will see a list of active goals to select. Note that a goal must be made first in order to appear in this menu.

How do I edit or delete a goal?

To edit or delete a goal, simply click on the goal. You can then make changes. Please note that edited changes will take effect based on the date you select while editing. Funds allocated to deleted goals are returned to the main or checking account.

What happens to my allocated funds when a goal is completed?

Upon completion, the goal’s funds are associated with the goal and the parent is expected to use these funds to help the kid to receive the goal objective. They are removed from the account.

What happens to my allocated funds when I cancel a goal?

When you delete an active goal (meaning it is not completed yet), all the funds return to your account. If you are using Bankaroo Plus, funds are returned to the savings account.

International Support

What currencies does Bankaroo support?

Bankaroo is a virtual bank and as such it can support any currency. When you create the account you can select from the following list:

In case you do not see the currency you need, please let us know and we would be happy to add it. Contact support@bankaroo.com.

Can I set multi-currency accounts?

Currently, each kid account can have only one currency. However, you can open separate kids accounts with different currencies. For example, “Dani USD” can use American dollars while “Dani CAD” uses Canadian dollars. Please note that in the case of fund transfers between accounts, Bankaroo does not convert based on currency, but simply transfers the numerical amount. $40 USD → $40 CAD.

Currently, each kid account can have only one currency. However, you can open separate kids accounts with different currencies. For example, “Dani USD” can use American dollars while “Dani CAD” uses Canadian dollars. Please note that in the case of fund transfers between accounts, Bankaroo does not convert based on currency, but simply transfers the numerical amount. $40 USD → $40 CAD.

What languages does Bankaroo support?

REVIEW

Bankaroo for schools

What is Bankaroo for Schools?

Bankaroo for Schools is an online portal that helps school administrators and teachers manage multiple classes of students using a single interface. Teachers can use it to teach math or finance, or to use it as a behavioral point system. Each student has access to his or her account using a username and password provided by the teacher.

Can I use Bankaroo for my school?

Sure! We offer Bankaroo for school free for the first class in each school. Sign up here: https://www.bankaroo.com/for-school/

How can I introduce Bankaroo to a teacher or a school admin?

REVIEW